Wouldn’t it be easy to make money if you just knew the future? I remember my trading days, pouring over charts, convinced that I could tell the future with my technical analysis. I always believed that if only I had a little more time an a little more data, things would work out eventually and I would be wealthy and successful in the market. And yet, as much as I may have believed that I had mastered the mathematics of predicting the next move in the price chart, it never worked out for me – and if it had I would have retired a long time ago.

The dream of being able to predict the future price movement of markets remains alive in financial institutions and businesses of all types. With every advancement in technology, there comes another opportunity to gain an edge in the market and make a fortune. Artificial intelligence, and in particular deep learning, is one such technology. In this article we will discuss how these technologies are being used in financial forecasting and what they future may hold for businesses that use are reaching for some of these new tools.

Table of Contents

Understanding Deep Learning and Financial Forecasting

The Role of Deep Learning in Finance

Deep learning is a subset of artificial intelligence (AI) that has gained significant attention in recent years due to its ability to process large amounts of data and learn from it. In the finance industry, deep learning has found numerous applications, such as predicting stock prices, algorithmic trading, and risk management. The advancements in deep learning have made it possible for finance practitioners to create models that can provide real-time working solutions for their industry.

Basics of Financial Forecasting

Financial forecasting is the process of predicting the future performance of a company or an investment instrument based on historical data and various other factors. Deep learning algorithms, such as neural networks, can analyze patterns and trends in financial time series data, enabling finance professionals to make more informed decisions. Forecasting financial time series involves predicting future values in a series based on past and present data.

The use of deep learning in financial forecasting has provided the industry with more accurate and efficient forecasting models. These models can process large amounts of data quickly, which can lead to improved financial forecasts and better decision-making for investors, traders, and other stakeholders.

Deep Learning Models in Financial Forecasting

Application of LSTM in Financial Forecasting

Long-Short Term Memory (LSTM) is a type of recurrent neural network (RNN) that is particularly beneficial for analyzing time series data. LSTMs have the ability to remember patterns over long sequences, making them well-suited for financial time series forecasting.

One of the key advantages of LSTM is its ability to learn from different time scales and capture complex patterns in the data. This allows it to forecast fluctuations in stock prices, currency exchange rates, and other financial variables with higher accuracy than traditional machine learning models.

Several studies have demonstrated the efficiency of LSTM in financial forecasting. For instance, LSTM-based models have been successfully applied in:

- Stock price prediction

- Forex exchange rate forecasting

- Commodity market analysis

Convolutional Neural Networks in Finance

Convolutional Neural Networks (CNNs) are primarily known for their applications in image and video processing. However, they have also shown great potential in financial forecasting due to their ability to learn local and global patterns in the data.

A common approach for using CNNs in finance is to transform time series data into a grid-like structure. This allows the model to capture the spatial and temporal relationships between different financial variables in a more efficient manner.

CNNs have been successfully applied in various financial forecasting tasks, such as:

- Index prediction

- Volatility estimation

- Risk management

Data and its Impact on Forecasting

Managing Financial Data

Financial data is typically heterogeneous, multi-sourced, and imbalanced, which can make it challenging to manage and analyze. One of the key factors in successful financial forecasting is the proper management of financial data. This includes collecting and cleaning data, ensuring its accuracy, and transforming it into a format that can be readily used by deep learning algorithms. In addition, continuous monitoring and updating of the data is critical to stay up-to-date with market changes and trends.

Some of the common data sources used in financial forecasting include historical stock prices, financial news, social media sentiment, and economic indicators. The more diverse and accurate the data used in forecasting models, the better the predictions tend to be.

Big Data’s Role in Forecasting

The growth of big data has significantly impacted financial forecasting. With the sheer volume of data available, machine learning algorithms can now extract information from large datasets to uncover hidden patterns and trends. Big data allows for a more comprehensive understanding of financial markets, leading to better informed and more accurate predictions.

Deep learning techniques, such as Recurrent Neural Networks (RNNs) and Convolutional Neural Networks (CNNs), have proven especially effective in handling and analyzing large amounts of financial data. These techniques can learn from complex patterns in data and adapt to changing market conditions, enhancing the forecast accuracy.

By harnessing the power of big data and deep learning, financial forecasting has surpassed traditional methods and continues to evolve, offering new insights and opportunities in the world of finance.

Advanced Techniques in Financial Forecasting

Advanced Techniques in Financial Forecasting

Sentiment Analysis and Forecasting

In recent years, sentiment analysis has emerged as an important technique in financial forecasting. By analyzing the emotions and opinions expressed in news articles, social media, and other textual data sources, sentiment analysis can provide valuable insights into the market’s perception of a particular asset or financial instrument. By incorporating this information into their forecasting models, financial analysts can improve the accuracy of their predictions and make better-informed investment decisions.

One popular forecasting method that can be combined with sentiment analysis is ARIMA (AutoRegressive Integrated Moving Average). This method analyzes historical time series data to predict future values, and by incorporating sentiment scores into the model, financial analysts can enhance their understanding of the underlying trends and anticipate potential market shifts.

Algorithmic Trading using AI

Algorithmic trading is an advanced technique that leverages artificial intelligence (AI) and deep learning to develop and execute financial trading strategies. These strategies are designed to identify patterns in financial markets and make trade decisions based on learned patterns and trends. The main goal of algorithmic trading is to minimize risks and maximize returns through rapid and intelligent trading decisions.

Deep learning models have become increasingly popular in this field due to their capacity to learn complex and non-linear relationships from vast amounts of data. In financial forecasting and algorithmic trading, AI models can analyze market movements, economic indicators, and even sentiment data to make well-informed trading decisions in real-time.

The marriage of these advanced techniques – sentiment analysis, ARIMA, and deep learning – delivers a powerful combination that allows financial forecasters and traders to stay ahead of the curve and make informed decisions in an ever-changing market environment.

Challenges and Future Perspectives

Potential Setbacks of ML and DL in Finance

Despite the promising advancements in machine learning (ML) and deep learning (DL) for finance, there are some potential setbacks that could impede their implementation. One concern is the lack of transparency in the decision-making process of these algorithms. Due to the complex nature of deep learning models, it could be difficult for humans to understand and interpret the rationale behind their predictions, leading to hesitation in their adoption by financial professionals.

Data quality is another crucial factor that can impact the performance of ML and DL models. Financial time series data often contain noise, missing values, or irregularities, which could lead to suboptimal model performance. These models typically require a significant amount of data for training, but acquiring and cleaning historical financial data can be time-consuming and expensive.

ML and DL models could be susceptible to adversarial attacks, where malicious actors manipulate input data with the intent to confuse or mislead the model into making incorrect decisions. Security of these models is an ongoing challenge in the field.

Emerging Trends for Future Direction

Looking towards the future direction of DL research, several emerging trends are likely to shape the evolution of financial forecasting methodologies. Transfer learning, which allows the transfer of pre-existing knowledge from one domain to another, can potentially improve the performance of financial forecasting models. By leveraging data from related financial tasks or markets, models can be fine-tuned for specific forecasting scenarios without needing excessive amounts of training data.

Another promising trend is the integration of domain knowledge into model architecture. Researchers are developing DL models that incorporate expert financial knowledge in the form of prior distributions, constraint rules, or hybrid model structures. Such approaches can boost model interpretability, improve generalization, and increase trust in DL-based financial decision-making.

The application of reinforcement learning (RL) in finance is also gaining traction, as it can be used to model and optimize complex financial decisions. For example, RL may be employed to optimize portfolio management or algorithmic trading strategies, exploring various actions while maximizing long-term rewards. It’s important to note that the future direction of DL research will likely involve continuously refining and adapting models to address current setbacks and improve performance, bringing finance professionals closer to achieving reliable and efficient financial forecasting solutions.

Case Studies

Microsoft Azure in Finance

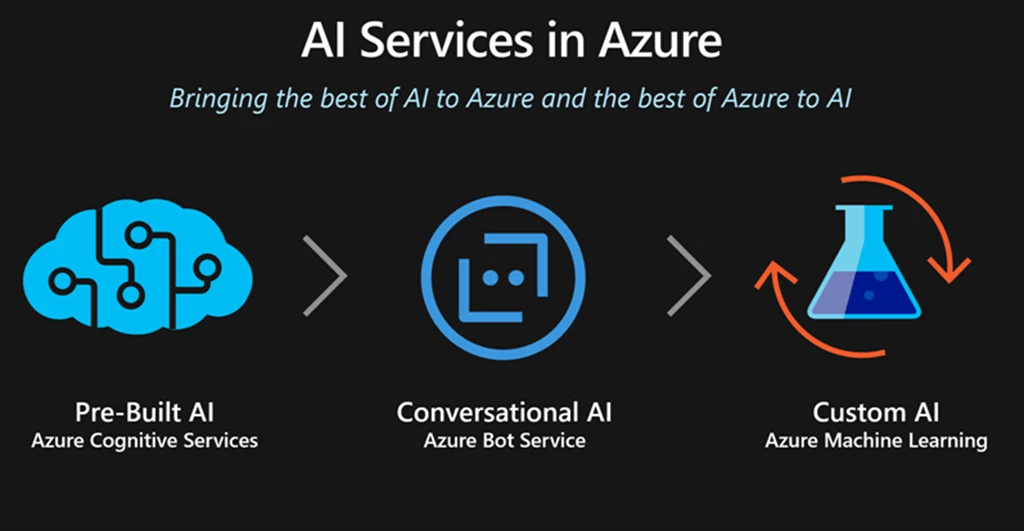

Microsoft Azure has made significant contributions to the finance industry by providing state-of-the-art deep learning tools for financial forecasting. Its cloud-based platform offers scalable computing power and a wide range of tools for analyzing and predicting financial time series data. Through the Azure Machine Learning service, users can access pre-built models, customize algorithms, and leverage large-scale data processing capabilities to handle complex financial data.

One example of Azure’s effectiveness in financial forecasting is its ability to analyze large datasets of historical financial data, helping institutions identify patterns and trends. By using Azure’s deep learning capabilities, financial professionals can extract valuable insights and improve their decision-making processes. Additionally, the platform offers tailored solutions for risk management, fraud detection, portfolio optimization, and more, enabling financial institutions to adapt to the rapidly changing industry landscape by harnessing the power of AI and deep learning.

Tensorflow’s Contribution to Financial Forecasting

TensorFlow, an open-source machine learning library created by Google, has become a popular choice for implementing deep learning models in financial forecasting. With its extensive built-in functionality, TensorFlow allows users to design and train complex models for analyzing and predicting financial time series data. Its flexibility and ease of use make it a valuable tool for researchers and professionals alike.

There are numerous examples of TensorFlow being used to forecast financial markets and develop trading strategies. For instance, studies have leveraged TensorFlow’s deep learning capabilities to predict the stock market, currency exchange rates, and volatility. These models, built using tools like convolutional neural networks (CNNs) and long short-term memory (LSTM) networks, have shown promising results in accurately forecasting financial trends.

By utilizing TensorFlow, financial experts can experiment with various network architectures, hyperparameters, and data preprocessing techniques to optimize their models for specific tasks.

Frequently Asked Questions

How is deep learning applied to financial time series forecasting?

Deep learning models, such as Convolutional Neural Networks (CNNs), Long Short-Term Memory (LSTM) networks, and Recurrent Neural Networks (RNNs), are utilized in predicting financial time series data. These models can process large amounts of historical data to recognize complex patterns and relationships, increasing the accuracy of their predictions 1. By training these models on large datasets, they can capture patterns and make more accurate predictions, thereby improving financial decision-making.

What are the recent developments in using AI for budgeting and financial planning?

Recent advancements in AI, specifically in machine learning, have expanded the potential for financial forecasting, planning, and analysis (FP&A) 2. By automating information extraction from large data sets, machine learning algorithms can identify relevant patterns and relationships, helping businesses optimize their financial strategies. This has led to improved forecasts, budget allocations, and resource planning.

What are common challenges in applying machine learning to financial forecasting?

Some of the significant challenges in applying machine learning to financial forecasting include high data requirements, model complexity, and risk of overfitting. In addition, the inherent uncertainty and volatility of financial markets can make it difficult for models to accurately predict future trends. It is also crucial to choose the appropriate algorithm depending on the data’s characteristics, ensure model interpretability, and regularly update the models to account for new information and market shifts.

What are notable books on time series forecasting with machine learning?

Several books focus on time series forecasting with machine learning, including “Practical Time Series Forecasting with R” by Galit Shmueli and “Financial Signal Processing and Machine Learning for Electronic Trading” by Ali N. Akansu, et al. These books cover various topics related to machine learning, finance, and time series analysis, providing practical guidance and methodologies for forecasting financial time series using machine learning techniques.

Which deep learning models are popular for financial time series prediction?

Popular deep learning models for financial time series prediction include Convolutional Neural Networks (CNNs), Long Short-Term Memory (LSTM) networks, and Recurrent Neural Networks (RNNs) 3. These models are favored due to their ability to capture complex patterns and relationships in the data, leading to more accurate predictions than traditional forecasting methods. Each model type has its strengths and potential applications, depending on the specific problem and available data.

How does Python facilitate deep learning for financial forecasting?

Python is a widely-used programming language in finance that offers several libraries and frameworks for deep learning applications. Some popular Python libraries for deep learning include TensorFlow, Keras, and PyTorch. These libraries provide intuitive APIs and built-in support for deep learning models, making it easier for analysts and practitioners to implement deep learning algorithms for financial forecasting applications. Python’s versatile and user-friendly nature has made it the language of choice for many financial professionals experimenting with deep learning techniques.

Advanced Techniques in Financial Forecasting

Advanced Techniques in Financial Forecasting

3 thoughts on “Financial Forecasting with Deep Learning: A Predictive Advantage”

The reputation of the website will surely see an improvement in the near future as a result of the high-quality content and the active involvement of the administrator.

I have been browsing online more than three hours today yet I never found any interesting article like yours It is pretty worth enough for me In my view if all website owners and bloggers made good content as you did the internet will be a lot more useful than ever before

Ive read several just right stuff here Certainly price bookmarking for revisiting I wonder how a lot effort you place to create this kind of great informative website